Finance Knowledge Built Around Real Experience

We teach financial literacy through practical lessons drawn from two decades working with Australian families and businesses. Our September 2025 program opens in April.

View Program Details

How Our Teaching Approach Works

Most finance education focuses on theory. We started from a different place—real client conversations and the questions people actually ask when making money decisions.

Foundation Through Real Scenarios

We start with actual financial situations—not textbook examples. You'll see how budgeting, debt, and savings decisions play out in real household contexts. These are the same scenarios our instructors worked through with clients over twenty years.

Building Your Analysis Skills

This is where things get interesting. You'll learn to spot patterns in financial data and understand what different numbers actually mean for decision-making. We use case studies from Australian businesses and households so you're working with familiar contexts.

Practical Application Projects

You'll work through complete financial scenarios—creating budgets, analyzing investment options, and planning for long-term goals. The projects mirror what you'd encounter managing your own finances or working in financial services.

Final Assessment and Feedback

Your final project involves creating a comprehensive financial plan. Our instructors provide detailed feedback based on what they've seen work in actual practice. It's about understanding whether you can apply this knowledge to real situations.

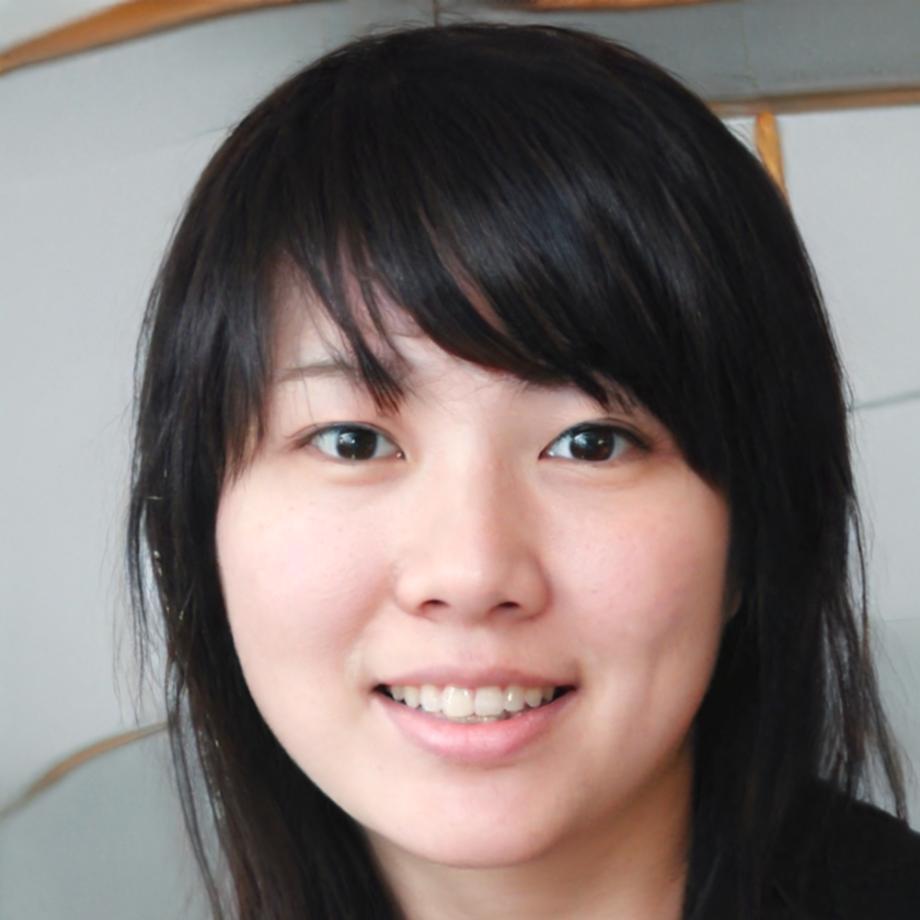

Siobhan Macleod

Lead Instructor

Teaching From Experience, Not Theory

Siobhan spent eighteen years as a financial advisor before switching to education in 2023. She got tired of seeing clients who didn't understand basic finance concepts—not because they weren't smart, but because nobody had explained things in practical terms.

Her teaching style reflects that frustration. Instead of starting with definitions and formulas, she begins with situations. What happens when you take on debt? How do you actually decide between investment options? When does it make sense to seek professional advice versus handling things yourself?

She builds the curriculum around questions her clients asked most often. The technical knowledge comes later, once you understand why you need it. This approach tends to work better for adult learners who want practical skills they can use immediately.

Siobhan holds a Graduate Diploma in Financial Planning and taught financial literacy workshops through community programs in northern New South Wales before developing this full program. Her background is in small business finance and personal wealth management—areas where understanding fundamentals makes a genuine difference.

What You'll Actually Learn

The program covers four main areas. We designed them to build on each other, but you can also focus on specific topics based on your goals.

Each area includes live instruction, practical exercises, and feedback sessions where you can ask questions about your own financial situations.

Personal Finance Foundations

Budgeting, debt management, and savings strategies that actually work for different life situations. We cover everything from emergency funds to planning major purchases.

Investment Basics

Understanding different investment types, risk assessment, and building a balanced portfolio. This section focuses on making informed decisions rather than chasing returns.

Business Finance Essentials

Cash flow management, basic financial statements, and pricing decisions for small businesses. Useful whether you're running a business or just want to understand how businesses think about money.

Ready to Start Learning?

Our next program begins September 2025. Registration opens in April. Classes run Tuesday and Thursday evenings for twelve weeks.

See Full Program Details